Vedanta Stock Falls 3% as selling pressure emerged following a deeply tragic development involving the company’s promoter family. Vedanta Ltd shares declined nearly 3% in intraday trade, retreating from their recent all-time high, after Chairman Anil Agarwal publicly mourned the sudden death of his son, describing it as the “darkest day of my life.”

While the loss is profoundly personal, markets responded with caution, reflecting investor sensitivity to uncertainty surrounding promoter families, leadership continuity, and near-term sentiment. The episode highlights how human tragedy and financial markets often intersect, especially in companies where promoters play a central public and strategic role.

Vedanta Share Price Movement: What Happened in the Market

Stock Retreats From Record High

Vedanta Stock Falls 3% despite the company’s recent strong upward trajectory, with shares having recently touched record high levels on the back of favorable market conditions and improved commodity prices.

- Improved commodity prices

- Strong dividend expectations

- Optimism around restructuring and debt management

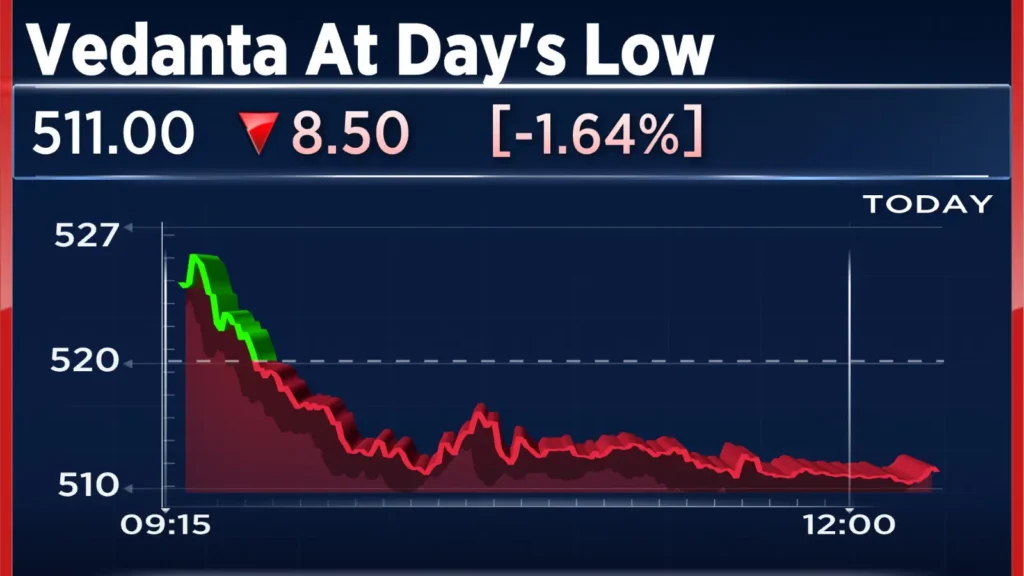

However, following the tragic news, the stock slipped around 3%, marking one of its sharpest single-day declines in recent weeks.

Trading Pattern and Volumes

- Early trade: Shares opened lower, reflecting immediate sentiment impact

- Intraday movement: Selling pressure intensified as volumes rose

- Closing trend: Stock remained below previous session’s close, signaling cautious positioning

Market participants described the move as a sentiment-driven correction, rather than a reaction to any change in business fundamentals.

Anil Agarwal’s Statement and Public Reaction

“Darkest Day of My Life”

Vedanta Stock Falls 3% as Chairman Anil Agarwal, one of India’s most prominent industrialists, expressed profound grief over the loss of his son. The news and his statement resonated deeply across social media, business circles, and the broader public.

The words “darkest day of my life” underscored the emotional gravity of the moment and prompted widespread condolences from:

- Business leaders

- Political figures

- Industry peers

- Employees and shareholders

Respectful Silence From the Company

Vedanta Ltd did not issue any operational or strategic update linked to the event, maintaining a clear separation between personal tragedy and corporate affairs. This approach is generally viewed as appropriate in such circumstances.

Why Markets React to Promoter Family Developments

The Role of Promoters in Indian Corporations

Vedanta Stock Falls 3% highlights how, in India, promoter-led companies often see the founder or promoter family play an outsized role in:

- Strategic direction

- Capital allocation

- Long-term vision

- Investor communication

As a result, any unexpected development involving promoter families can trigger short-term volatility, even when core business operations remain unaffected.

Sentiment Over Fundamentals

Market experts noted that Vedanta’s stock decline was largely driven by:

- Emotional overhang

- Short-term uncertainty

- Profit booking near record highs

There was no indication of operational disruption, financial distress, or governance breakdown linked to the event.

Vedanta’s Business Overview: A Diversified Natural Resources Giant

Core Business Segments

Vedanta Stock Falls 3% even as Vedanta Ltd operates across multiple resource-heavy sectors, including:

- Zinc, lead, and silver (via Hindustan Zinc)

- Aluminium

- Oil and gas

- Iron ore and steel

- Power generation

This diversification provides resilience against downturns in any single commodity cycle.

Global Footprint

Vedanta has operations in:

- India

- Africa

- Australia

- Middle East

Its global scale makes it one of the most influential natural resource groups with Indian roots.

Financial Performance: Fundamentals Remain Intact

Revenue and Profitability

Recent quarters have shown:

- Stable to improving revenues

- Strong cash flows from core operations

- Margins supported by favorable commodity prices

Despite market volatility, analysts continue to view Vedanta as a cash-generating business with substantial dividend-paying capacity.

Debt and Deleveraging Efforts

Vedanta Stock Falls 3% as one of the key investor concerns around Vedanta has historically been debt levels. In response, the company has:

- Focused on asset monetization

- Increased dividend flows from subsidiaries

- Streamlined capital expenditure

Progress on deleveraging has been a key driver of the recent rally, which makes the current pullback appear more corrective than structural.

Dividend Expectations and Shareholder Focus

Why Income Investors Track Vedanta Closely

Vedanta is widely known for its:

- High dividend payouts

- Regular capital returns to shareholders

In recent years, dividends have been a major attraction, particularly for:

- Institutional investors

- Income-focused retail investors

- Long-term shareholders

The recent stock decline did not come with any announcement affecting dividend policy.

Market View on Dividends Post-Correction

Analysts suggest that unless commodity prices fall sharply or debt metrics worsen, Vedanta’s dividend thesis remains unchanged in the near term.

Vedanta Ltd, a diversified natural resources company, operates across multiple sectors, including metals and mining Vedanta Official Website

Investor sentiment has also been shaped by broader macroeconomic pressures, including currency volatility. The recent rupee hitting ₹91 against the US dollar has added to market caution, particularly for metal and mining stocks that are sensitive to global pricing and import costs.