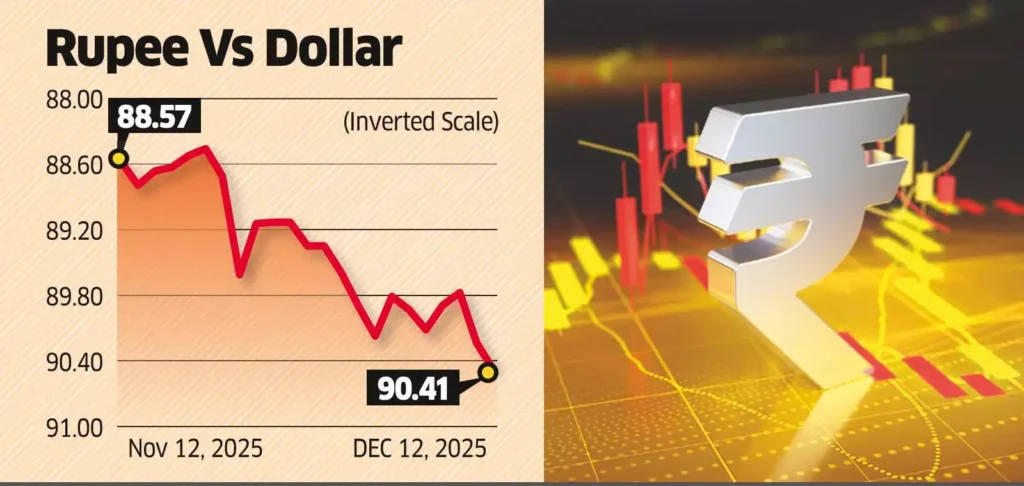

The Rupee Hits ₹91 vs Dollar – RBI Under Pressure to Intervene, as the Indian currency slipped past the psychologically significant ₹91-per-dollar mark for the first time in history. This sustained decline, characterized by a near one-way movement over the past month, has intensified speculation that the Reserve Bank of India (RBI) may step in more aggressively to stabilize the currency. Market participants, including bankers and currency traders, note that the rupee’s persistent weakness—largely decoupled from other Asian currencies—mirrors previous periods when the central bank intervened decisively to curb excessive volatility.

Rupee’s Month-Long Decline Raises Alarm Bells

Over the last month, the Rupee Hits ₹91 vs Dollar – RBI Under Pressure to Intervene, as it depreciated by around 2.5%, highlighting growing stress in India’s external balance and persistent demand for the US dollar. Unlike routine fluctuations driven by global risk sentiment or regional cues, dealers say the recent decline has been structural and flow-driven. On Tuesday, the rupee fell 0.3% in a single session, breaching the 91 mark despite relatively stable conditions across Asian currency markets. This divergence has heightened concerns that unchecked depreciation could fuel speculative positioning, imported inflation, and further capital outflows. Bankers emphasize that when a currency weakens consistently regardless of peer performance, it often reflects one-sided market positioning—a scenario central banks typically move to counter.

Dollar Demand Overwhelms the Market

The Rupee Hits ₹91 vs Dollar – RBI Under Pressure to Intervene, driven primarily by a significant imbalance in dollar flows, where demand far outweighs supply. Several factors are intensifying this pressure:

- Importer Hedging Intensifies

Indian importers, especially in energy, electronics, and industrial sectors, are rushing to hedge future dollar payments amid fears of further rupee weakness. This surge in hedging activity has added to near-term dollar demand. - Foreign Portfolio Investors Remain Cautious

Global investors are hesitant to increase exposure to Indian equities due to valuation concerns and international uncertainty. Persistent equity outflows or muted inflows reduce dollar supply in domestic markets, putting additional pressure on the rupee. - Trade Deal Uncertainty with the US

The absence of a concrete US–India trade agreement has weighed on market sentiment. Expectations of export-led support and improved capital flows remain unmet, reinforcing caution.

Combined, these factors have created a market environment dominated by dollar demand, leaving little room for natural rupee recovery and keeping the RBI under pressure to intervene.

Rupee Decouples from Asian Currency Trends

One of the most striking aspects of the current episode is that the Rupee Hits ₹91 vs Dollar – RBI Under Pressure to Intervene, sharply underperforming its Asian peers. While the Indian currency has slid to record lows, several regional currencies have moved in the opposite direction:

- The Thai baht has strengthened by more than 3% over the past month

- The Chinese yuan, Malaysian ringgit, and Singapore dollar have each gained at least 1%

- Broader Asian currency indices have shown relative stability or mild appreciation

This contrast underscores that the rupee’s weakness is driven more by domestic flow dynamics than global dollar strength. Traders note that the currency has become less responsive to daily moves in peer markets, allowing downward momentum to build unchecked and keeping expectations of RBI intervention high.become less responsive to daily moves in peer markets, allowing downward momentum to build unchecked.

One-Way Trade Raises Speculative Risks

A sustained directional move often attracts speculative positioning, especially when market consensus begins to form around further depreciation. Traders say that sentiment has increasingly turned bearish, with many participants expecting the rupee to weaken further unless the RBI intervenes.

“When a market starts to believe that a currency will only move in one direction, it creates self-reinforcing pressure,” said a trader at a state-run bank. “That’s when central banks typically act—not to defend a specific level, but to restore two-way movement.”

Speculative activity, if left unchecked, can amplify volatility and complicate monetary management, especially in an economy as large and import-dependent as India’s.

RBI’s Past Playbook Signals Possible Action

The growing chatter about RBI intervention is not without precedent. Earlier this year, the central bank acted decisively during similar periods of rupee stress.

Heavy Intervention Episodes in 2025

- February: The RBI stepped into both spot and non-deliverable forward (NDF) markets after the rupee weakened persistently despite stable global cues.

- October: A renewed bout of selling triggered large-scale dollar sales by the RBI to halt speculative momentum.

- Last Month: The central bank intervened forcefully on two separate occasions, deploying significant volumes to prevent disorderly moves.

Market participants emphasise that these were not routine, day-to-day operations.

“Those were interventions with size,” said one banker. “The RBI came in strongly to break the trend and bring two-way trade back into the market.”

Given the similarity in current market conditions, many believe a repeat response may be imminent.

RBI’s Strategy: Stability Over Levels

Importantly, the RBI has consistently maintained that it does not target a specific exchange rate, but intervenes to curb excessive volatility and ensure orderly market conditions.

Allowing gradual depreciation aligned with economic fundamentals is one thing. But a near one-way slide, particularly one driven by flow imbalances and speculation, runs counter to the RBI’s stated policy framework.

A sharp or disorderly fall in the rupee can have several consequences:

- Higher imported inflation, especially for fuel and commodities

- Increased hedging costs for businesses

- Pressure on corporate balance sheets with unhedged foreign debt

- Erosion of investor confidence

These risks explain why traders believe the RBI may step in sooner rather than later.

Psychological Impact of the 91 Level

Crossing the ₹91-per-dollar mark is not just a numerical milestone—it carries psychological weight.

Round numbers often act as sentiment anchors in currency markets. Once breached, they can trigger stop-loss orders, fresh hedging demand, and media-driven anxiety, all of which can accelerate the move.

Bankers say that the breach of 91 has already led to increased caution among importers and corporates, many of whom now fear that higher levels could be tested if the trend continues.

How Intervention Could Play Out

If the RBI does decide to intervene more forcefully, it has several tools at its disposal:

1. Spot Market Dollar Sales

The most visible form of intervention, where the RBI sells dollars directly to absorb excess demand and support the rupee.

2. NDF Market Operations

By influencing offshore non-deliverable forward markets, the RBI can dampen speculative positioning that feeds into onshore weakness.

3. Liquidity Management

Adjusting rupee liquidity conditions to make speculative positions more expensive.

Market participants say the central bank’s recent interventions have been well-calibrated, aimed at discouraging one-sided bets without causing panic or sharp reversals.

Not a Crisis, But a Cautionary Phase

Despite the current pressure, most economists stress that the rupee’s weakness does not signal a balance-of-payments crisis. India’s foreign exchange reserves remain substantial, providing the RBI with ample firepower to manage volatility.

However, the ongoing slide highlights structural vulnerabilities, including dependence on imports, sensitivity to global capital flows, and the need for sustained export growth.

In the near term, much will depend on:

- Global risk sentiment

- Direction of US interest rates

- Progress on trade and investment agreements

- RBI’s willingness to lean against market momentum

Market Consensus Shifts Toward Intervention

As expectations of further depreciation build, so does the belief that the RBI will step in.

“With market consensus now leaning strongly toward a weaker rupee, the probability of heavier intervention has clearly increased,” said a senior currency dealer.

History suggests that when expectations become too one-sided, the central bank prefers to act—not to reverse the trend entirely, but to restore balance and discipline.

Read more about RBI interventions on the Reserve Bank of India website (https://www.rbi.org.in).

For more details on the RBI’s recent monetary measures, check out our article on the RBI cutting the repo rate to 5.25%.