RRB IPO Blueprint Deadline Set by Finance Ministry The Ministry of Finance has recently taken a significant step in shaping the future of regional rural banks (RRBs) in India. As per reliable sources, three prominent RRBs — Haryana Gramin Bank, Kerala Gramin Bank, and Tamil Nadu Grama Bank — have been asked to submit their draft Initial Public Offering (IPO) plans to their respective sponsor banks as well as the Department of Financial Services (DFS) by the end of March 2026.

This move is part of a broader strategy by the government to enhance transparency, mobilize capital, and modernize rural banking infrastructure through public participation. Senior officials of the government, while speaking on the condition of anonymity, confirmed that the DFS convened a high-level review meeting on Tuesday to evaluate the IPO proposals submitted by these RRBs.

The meeting was attended by key personnel from the RRBs and their respective sponsor banks, alongside senior representatives from the Department of Financial Services, highlighting the seriousness and strategic importance of this initiative.

Understanding the Context: Why IPOs for RRBs?

RRB IPO Blueprint Deadline Set by Finance Ministry Regional rural banks (RRBs) were established in India in the early 1970s with the primary goal of providing banking services in rural areas, promoting financial inclusion, and supporting agriculture and small enterprises. Over the decades, these banks have become an essential component of India’s rural financial system, catering to millions of farmers, small entrepreneurs, and rural households.

Despite their critical role, many RRBs have traditionally been under-capitalized, with limited access to markets for raising funds. Most RRBs operate under the guidance of their sponsor banks, which are typically large public sector banks. While this sponsorship ensures stability and regulatory oversight, it also limits the autonomy of RRBs in raising funds independently.

By allowing RRBs to launch an IPO, the government is taking a progressive step toward market-driven capitalization. An IPO not only helps in raising fresh capital but also improves governance, accountability, and operational transparency. It gives investors, including retail and institutional participants, a chance to directly participate in the growth of rural banking institutions.

RRBs in Focus: Haryana, Kerala, and Tamil Nadu

RRB IPO Blueprint Deadline Set by Finance Ministry The Finance Ministry’s directive specifically mentions Haryana Gramin Bank, Kerala Gramin Bank, and Tamil Nadu Grama Bank. These banks were likely chosen based on a combination of financial stability, market readiness, and operational efficiency.

- Haryana Gramin Bank

- Established to serve rural communities across Haryana, this bank has been instrumental in supporting agriculture and rural entrepreneurship.

- Over the years, it has improved its loan recovery rates and enhanced technological adoption, making it a viable candidate for public listing.

- Kerala Gramin Bank

- Kerala Gramin Bank serves as a backbone for the rural economy in Kerala. Its consistent performance in agriculture lending, financial inclusion programs, and digital banking services positions it well for an IPO.

- A public listing would allow the bank to expand its capital base, supporting newer initiatives like microfinance, small business lending, and rural infrastructure projects.

- Tamil Nadu Grama Bank

- Tamil Nadu Grama Bank has been at the forefront of providing financial services in Tamil Nadu’s rural districts.

- With a strong sponsor bank partnership, improved technology adoption, and consistent regulatory compliance, this RRB is poised to attract investor interest through an IPO.

The Role of Sponsor Banks

RRB IPO Blueprint Deadline Set by Finance Ministry Each RRB operates under a sponsor bank, which is typically a public sector bank tasked with guiding the RRB in terms of governance, capital planning, and operational oversight. Sponsor banks play a crucial role in:

- Reviewing IPO plans submitted by RRBs.

- Ensuring regulatory compliance with the Securities and Exchange Board of India (SEBI) norms.

- Assisting RRBs in capital structuring, including equity and debt considerations.

- Supporting marketing and investor outreach during the IPO process.

The Finance Ministry’s instruction to submit IPO drafts to both the sponsor banks and the DFS ensures a multi-layered review, combining regulatory oversight with market readiness evaluation.

The Department of Financial Services (DFS) Meeting

RRB IPO Blueprint Deadline Set by Finance Ministry The DFS convened a meeting on Tuesday to review the IPO strategies of the three RRBs. The discussion focused on multiple aspects, including:

- Draft capital planning and financial structuring.

- Risk assessment and mitigation strategies.

- Valuation of assets and potential market capitalization.

- Proposed use of IPO proceeds, particularly for expanding rural operations, technological upgrades, and strengthening lending capacity.

Officials emphasized that the Capital Planning Committee and its sub-committees are responsible for closely monitoring the IPO preparation, ensuring adherence to financial norms, governance guidelines, and investor protection measures.

The meeting underscored the importance of transparency, accountability, and operational efficiency. By reviewing the IPO blueprints in detail, the DFS aims to facilitate a smooth listing process and safeguard the interests of investors and rural stakeholders.

Benefits of RRB IPOs

RRB IPO Blueprint Deadline Set by Finance Ministry The potential IPOs of RRBs offer several significant benefits:

- Enhanced Capital Base

- By raising funds through public investment, RRBs can expand lending to rural borrowers, including farmers, micro-entrepreneurs, and small businesses.

- Improved Governance and Transparency

- Public listing requires compliance with SEBI’s regulatory framework, which enhances accountability and governance standards.

- Market Exposure and Valuation

- IPOs expose RRBs to market forces, ensuring proper valuation and efficient capital allocation.

- Expansion and Technological Upgrades

- Proceeds from the IPO can be used to invest in digital banking, rural fintech solutions, and infrastructure expansion, improving accessibility in remote areas.

- Increased Investor Participation

- IPOs provide an opportunity for retail investors to participate in the growth of rural financial institutions, promoting financial inclusion from the investment side.

Challenges and Considerations

RRB IPO Blueprint Deadline Set by Finance Ministry While the IPO initiative is a positive step, several challenges need careful consideration:

- Market Readiness

- RRBs need to ensure their financial statements, asset quality, and governance practices meet market expectations.

- Pricing and Valuation

- Accurate valuation is critical to attract investors while ensuring the government and sponsor banks retain adequate control.

- Regulatory Compliance

- SEBI and RBI regulations need to be meticulously followed to prevent delays or legal complications.

- Operational Efficiency

- The success of an IPO often depends on the bank’s ability to manage operational risks and maintain a strong customer base.

- Investor Confidence

- Effective communication about growth potential, risk management, and social impact will be crucial in building investor trust.

Timeline and Next Steps

RRB IPO Blueprint Deadline Set by Finance Ministry According to the Finance Ministry’s directive:

- The three RRBs must submit their draft IPO plans by the end of March 2026.

- The DFS and sponsor banks will review these submissions to assess capital requirements, market readiness, and strategic alignment.

- Based on the feedback, the RRBs may revise their IPO proposals before launching the public offering.

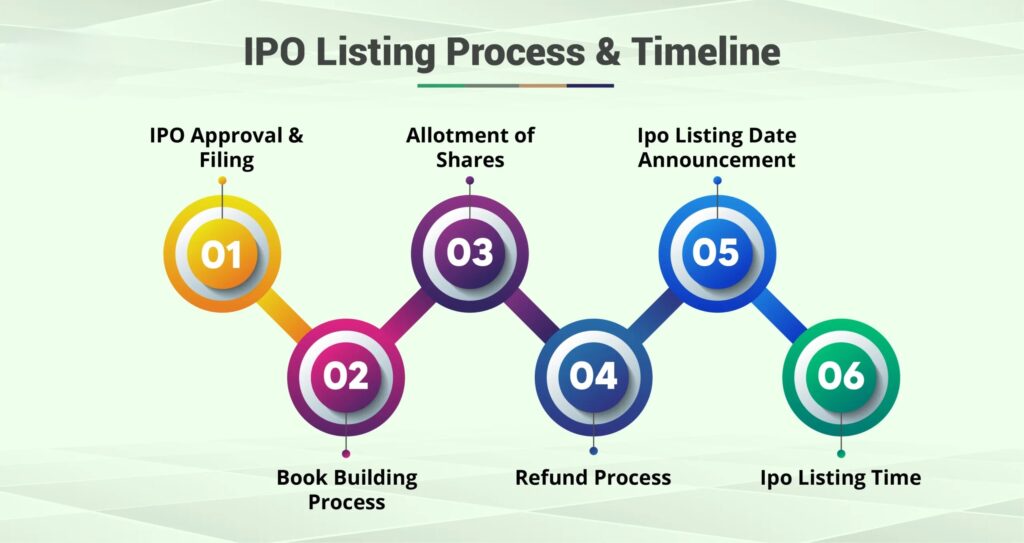

- Once approved, the IPO process will proceed, including filing with SEBI, investor roadshows, and final pricing.

This timeline suggests that by mid-2026, one could expect these RRBs to be well-prepared for public listing, opening new avenues for investment in rural banking.

Implications for Rural Banking and Economy

RRB IPO Blueprint Deadline Set by Finance Ministry The proposed IPOs have far-reaching implications for India’s rural economy:

- Boost to Financial Inclusion

- Increased capital allows RRBs to expand outreach, provide loans, and introduce innovative financial products to underserved areas.

- Support for Agriculture and Small Enterprises

- With additional funds, RRBs can enhance credit availability to farmers and small business owners, supporting rural economic growth.

- Market-Driven Governance

- Being listed on stock exchanges will push RRBs to adopt better risk management practices, improve efficiency, and align with market expectations.

- Strengthened Sponsor Banks

- Sponsor banks will benefit indirectly as their RRBs gain autonomy, better capitalization, and higher operational efficiency.

- Investor Opportunities

- Retail and institutional investors will have a chance to participate in the growth of rural finance, combining financial returns with social impact.

For more information on IPO regulatory compliance and listing requirements, readers can refer to the Securities and Exchange Board of India’s official website at https://www.sebi.gov.in.

For additional context on India’s financial landscape and market sentiment, readers can also explore our article on the rupee hitting ₹91 against the dollar and its impact on the economy and RBI measures: https://skinnyzine.com/rupee-hits-%e2%82%b991-vs-dollar-skinny-zine/.