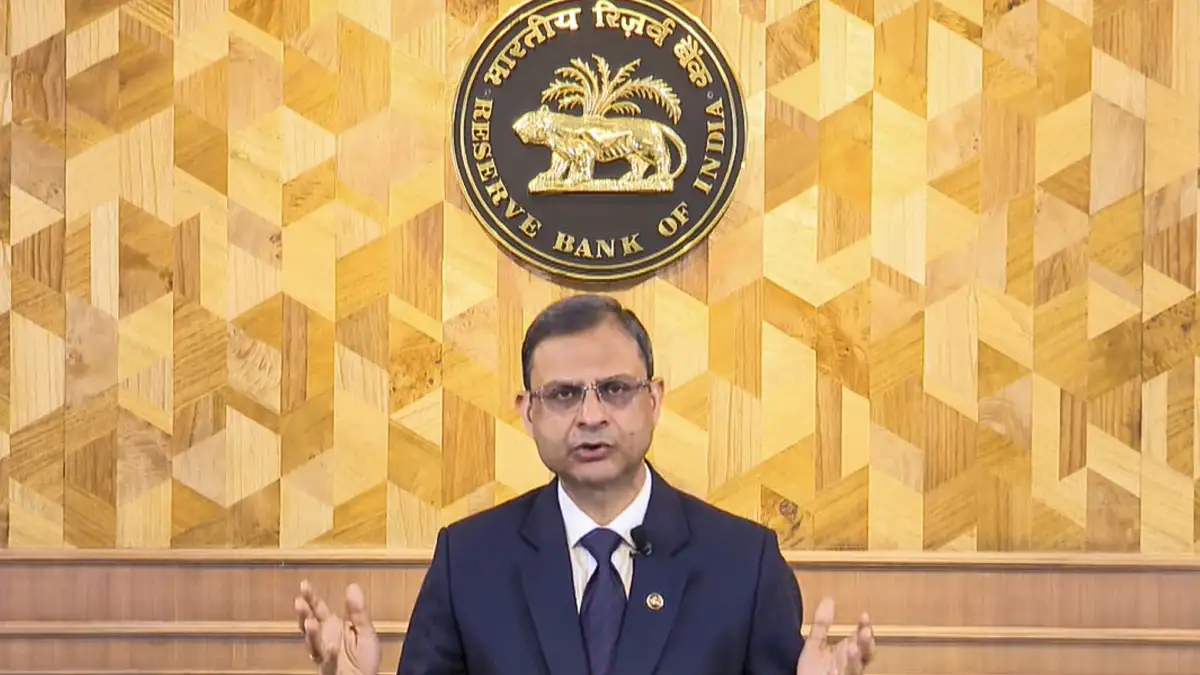

In a development closely monitored by economists, financial markets, and industry bodies across the country, Reserve Bank of India (RBI) Governor Sanjay Malhotra has indicated that current macroeconomic trends suggest there may be room for a repo rate cut in the near future. His remarks come just days before the highly anticipated Monetary Policy Committee (MPC) meeting scheduled from December 3 to December 5, sparking discussions on whether India may finally pivot towards a softer monetary policy stance after months of stability.

The possibility of a rate cut is being viewed as a potential turning point for the economy, especially as inflationary pressures begin to ease and global financial dynamics show signs of stabilization. While Malhotra stopped short of confirming any policy decision, he emphasized that the final call rests with the MPC, the statutory body responsible for steering the country’s interest rate framework.

Why a Rate Cut Matters

The repo rate, which is the interest rate at which the RBI lends money to commercial banks, plays a central role in determining borrowing costs across the economy. A reduction in the repo rate generally leads to:

- Lower loan interest rates for businesses and consumers

- Increased spending and borrowing activity

- A boost to sectors like real estate, automobiles, manufacturing, and MSMEs

- A push toward economic expansion through enhanced liquidity

On the other hand, a rate cut can also risk fueling inflation if executed at a time when price pressures are still elevated. This is why the decision is always calculated, cautious, and deeply tied to multiple macroeconomic data points.

Economic Climate Leading to Policy Reconsideration

Sanjay Malhotra’s statement reflects the current economic reality—where key indicators signal stabilization and forward movement after a prolonged period of global uncertainty.

1. Inflation Trends Are Moderating

While inflation has remained a significant concern throughout the year due to fluctuating food and energy prices, recent data suggests that the rate is gradually returning toward the RBI’s comfort zone. Factors contributing to this moderation include:

- Improved agricultural supply after a delayed but stable monsoon

- Decline in international crude oil prices

- Better supply chain management post-pandemic recovery

A sustained decline in inflation strengthens the case for lowering the repo rate.

2. GDP Growth Remains Resilient

Despite global economic slowdowns, India’s GDP growth continues to outperform major economies. Indicators like industrial output, GST collections, and manufacturing PMI (Purchasing Managers’ Index) show positive momentum.

If the growth outlook remains strong, a calibrated rate cut could further stimulate investments and domestic demand.

3. Global Monetary Trends Are Shifting

Worldwide, central banks that previously adopted aggressive rate hikes to tackle inflation are now signaling pauses or softening their stance. This includes the U.S. Federal Reserve, Bank of England, and European Central Bank.

A shift in the global financial environment makes it easier for the RBI to consider a rate cut without risking capital outflows or currency volatility.

Impact on Sectors and Consumers

If the MPC decides to go ahead with a repo rate cut, its effects would ripple across the economy.

Real Estate and Housing Loans

Homebuyers stand to benefit the most. Housing loan EMIs could drop, making affordability less of a barrier—especially for first-time buyers. A rate reduction may revive demand in tier-2 and tier-3 cities as well.

Automobile and Consumer Finance

Auto loans, personal loans, and education loans may become cheaper, boosting demand for big-ticket purchases that witnessed moderate growth in recent quarters.

Businesses and MSMEs

Lower interest rates reduce the cost of capital. For MSMEs and entrepreneurs facing rising input costs and cash-flow constraints, a repo rate cut may provide relief and encourage expansion and hiring.

Why the RBI Has Been Cautious So Far

While expectations of a rate cut have surfaced before, the RBI has maintained a stable stance since early 2024. This cautious approach was driven by:

- Concerns over food inflation volatility

- Geopolitical disruptions affecting commodity prices

- The need to avoid triggering inflationary spikes during elections and seasonal spending periods

The RBI’s priority has consistently been maintaining price stability, which remains its core mandate under India’s monetary policy framework.

What Analysts Are Predicting

Market experts are now divided on the timing of the cut:

| Viewpoint | What Analysts Expect |

|---|---|

| Immediate Cut in December | Some believe the RBI may announce a symbolic 25-basis-point cut to signal monetary easing. |

| Cut in Early 2026 | Others expect the RBI to wait for more data to ensure inflation remains stable. |

| No Cut Until Global Stability Deepens | A smaller segment believes the central bank may delay action until there is clearer alignment with global market conditions. |

Despite differing opinions, one consensus remains clear: India may soon be moving toward a new phase of monetary softening.

The Road Ahead: What to Expect

As the MPC prepares to meet from December 3–5, all eyes will be on the deliberations and its policy document. Even if the committee does not immediately cut rates, the tone of the policy guidance will likely provide insights into future actions.

Key signals to look for include:

- Revised inflation and growth forecasts

- Comments on liquidity conditions

- Forward-looking stance (“accommodative,” “neutral,” or “hawkish”)

A shift from the current stance toward a more accommodative approach would indicate that future rate cuts are likely.